I will go to the family dinner soon. Yeah, we arrived at the airport late last night and I feel so exhausted now!

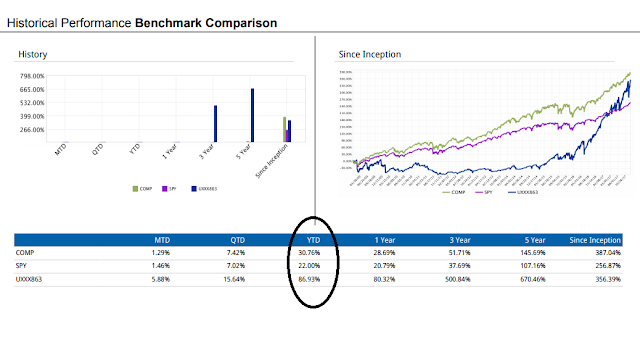

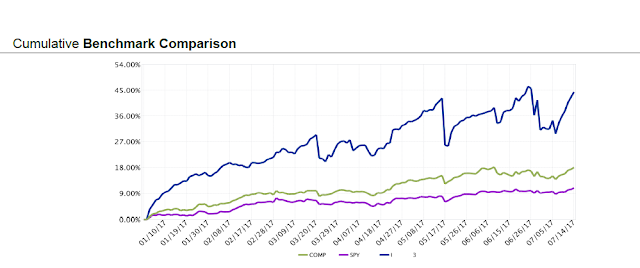

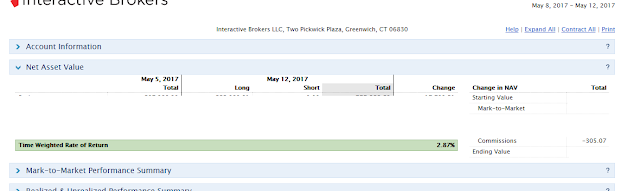

Here is the return from IB. Actually I performed much better than I did in TD Ameritrade and it made me wonder why. I spent several weeks to compare these two. Gradually, I applied the similar trade to IB.

It's a pretty good year for me so far. But I think I will do better next year with TD ameritrade's thinkorswim platform help. I like the way they organize the positions. I wish I could have opened the account with them earlier. I probably won't transfer the entire fund to TD though.

My stock income is much higher than my other combined income. It means that we have to pay a lot of tax next year.

Monday, December 25, 2017

Thursday, December 21, 2017

Saturday, December 9, 2017

Weekly Summary

We might see some weakness in the beginning of the week.

I don't want to do much now since it's holiday and we are going to travel next week.

Saturday, November 25, 2017

Weekly review and what to expect next week.

Ok, Back to work. :-)

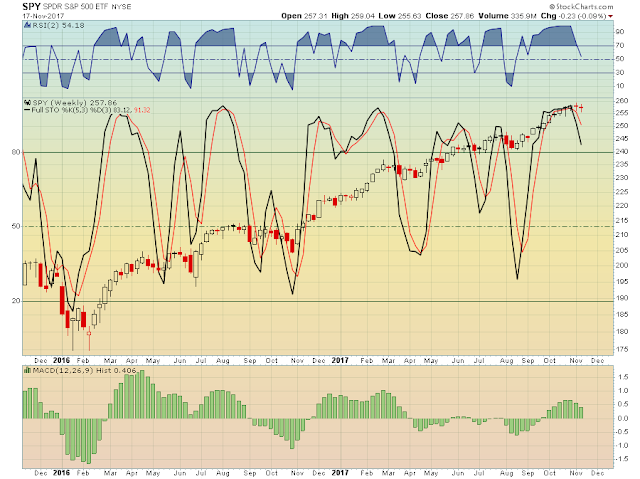

Although ES tried sever time above 2600, I'm not sure whether it will stay. It was a holiday week and the market tended to do the fake breakout. We'll see where the real market attention is next couple weeks. But no matter what, I don't see big pull back either.

I'm prepared either way. I will not jump to trade for the new fund available in TD. I will patiently wait that there is at least 14+ points move in SPX.

Trade Range for the past week: 2568-2603

The expect trading range is 2585+/5-2605+/-5

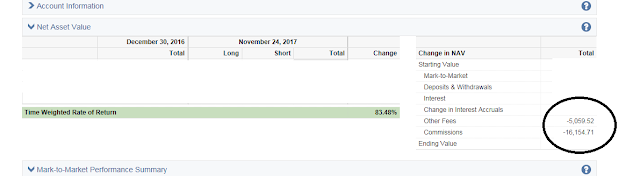

From the picture I posted, you can see that I've contributed to IB quite a bit. Hopefully I can see the difference from TD next year.

Although ES tried sever time above 2600, I'm not sure whether it will stay. It was a holiday week and the market tended to do the fake breakout. We'll see where the real market attention is next couple weeks. But no matter what, I don't see big pull back either.

I'm prepared either way. I will not jump to trade for the new fund available in TD. I will patiently wait that there is at least 14+ points move in SPX.

Trade Range for the past week: 2568-2603

The expect trading range is 2585+/5-2605+/-5

From the picture I posted, you can see that I've contributed to IB quite a bit. Hopefully I can see the difference from TD next year.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 23358.24 | 23557.99 | 199.75 | 0.9 | 19.2 |

| Nasdaq | 6782.79 | 6889.16 | 106.37 | 1.6 | 28.0 |

| S&P 500 | 2578.85 | 2602.42 | 23.57 | 0.9 | 16.2 |

| Russell 2000 | 1492.82 | 1519.16 | 26.34 | 1.8 | 11.9 |

Wednesday, November 22, 2017

Tuesday, November 21, 2017

New high,

It's so typical...

I don't want to wait any longer to switch the account. So I reduced quite a bit position in interactive brokers today. You can call it profit taking.

I think the fund should be available in TD next week. I hope that the market can have a big pull back by then!

Other than that, I'm not watching the market, I'm preparing the turkey now!

I don't want to wait any longer to switch the account. So I reduced quite a bit position in interactive brokers today. You can call it profit taking.

I think the fund should be available in TD next week. I hope that the market can have a big pull back by then!

Other than that, I'm not watching the market, I'm preparing the turkey now!

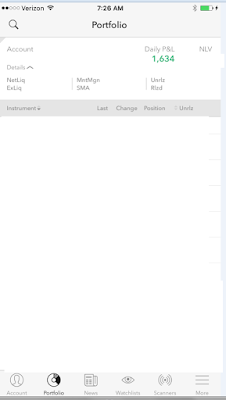

TD Ameritrade Account

It's a small account and I started to trade on 8/29/17. I went out lunch with a trader friend in September. He said that I should periodically withdraw money. I never have that habit and I listened to his advice. Here you go.

Maybe you should try it too, It's a good advice.

Maybe you should try it too, It's a good advice.

Saturday, November 18, 2017

I'm not very happy with Interactive brokers.

But the performance chart is pretty nice. I'd like to post it now since I will switch my main focus to TD Ameritrade next year. Unfortunately TD does not have good reporting system. But it doesn't matter.

Weekly Review

I did very well. I spent some time last weekend to check out my trading pattern, I wrote down what I needed to pay attention. As a result, I traded much less than I used to. It's discipline!

It was pretty challenge on Wednesday. I actually waited and didn't do anything until the last hour! The reward is pretty good.

Two weeks down, what to expect next week? More to come!

It was pretty challenge on Wednesday. I actually waited and didn't do anything until the last hour! The reward is pretty good.

Two weeks down, what to expect next week? More to come!

Friday, November 10, 2017

Weekly Review.

I lost money this week and I don't feel any pain. I don't want to give myself a hard time because I nailed the week's range but I ended up losing. I think it's about time for me to lose. The loss is manageable compared to the gains.

The last time I have weekly loss is the week of Aug 13th.

Actually I will probably review how I traded and what was in my head later... I'm going to relax now!

Here is what I did:

1. Overly bullish on Monday and Tuesday. Cut loss on the short position on Monday. I was too eager to trade. I should have waited for the last hour. That is the main reason I loss.

2. No trade on Wednesday.

3. More to come

The last time I have weekly loss is the week of Aug 13th.

Actually I will probably review how I traded and what was in my head later... I'm going to relax now!

Here is what I did:

1. Overly bullish on Monday and Tuesday. Cut loss on the short position on Monday. I was too eager to trade. I should have waited for the last hour. That is the main reason I loss.

2. No trade on Wednesday.

3. More to come

Tuesday, November 7, 2017

I probably will stop trading for this year pretty soon.

Or I just play very small amount of contracts of ES/NQ to stay in the game.

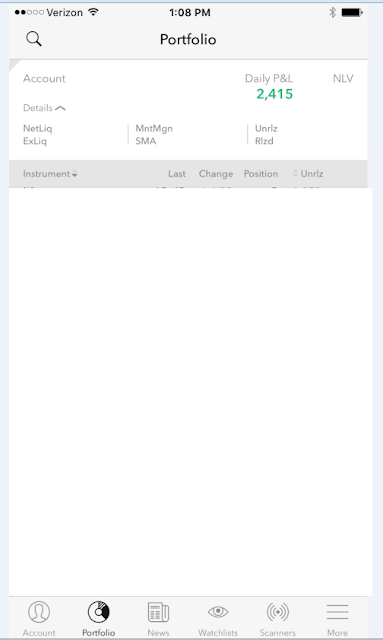

I opened a future trading account in TD Ameritrade at the end of August., I've made more money in TD than in IB. But TD does't provide the return curve like IB does. Other than that, I really like to trade in thinkorswim.

Here is the year return from the IB account. I'm pretty happy with it since the strategy works and I'm more calm when the market is not.

I opened a future trading account in TD Ameritrade at the end of August., I've made more money in TD than in IB. But TD does't provide the return curve like IB does. Other than that, I really like to trade in thinkorswim.

Here is the year return from the IB account. I'm pretty happy with it since the strategy works and I'm more calm when the market is not.

Sunday, November 5, 2017

What to expect next week?

My reader reminded me that I haven't written the market update for a while. Sorry, the market has been in this slow bull situation and I have shifted the focus away from the market.

Ok, I checked the market just now and here is my input:

Ok, I checked the market just now and here is my input:

We are at the earning season and most of the companies reported good earnings. There is no surprise in the FED notes last week. We also had a good job NFP report.

There are not much events going on next week. The volume will be light. I think ES range will be 2570+/-5 -2590+/-5

VIX: 9.1

Last last week: 2542-2574.

Last week: 2562-2585.5 close at 2583.

Nasdaq clearly broke out.

I think we will have a low opening on Monday and might have a low closing week also. Yes, I will add short at the upper range.

I did pretty well last week and as matter of fact, I haven't spent much time on it either. So the slowness in the market doesn't bother me at all. I guess that is also called self-adjustment.

Saturday, October 21, 2017

Weekly Review

Index

|

Started Week

|

Ended Week

|

Change

|

% Change

|

YTD %

|

DJIA

|

22871.72

|

23328.63

|

456.91

|

2.0

|

18.0

|

Nasdaq

|

6605.80

|

6629.05

|

23.25

|

0.4

|

23.1

|

S&P 500

|

2553.17

|

2575.21

|

22.04

|

0.9

|

15.0

|

Russell 2000

|

1502.66

|

1509.25

|

6.59

|

0.4

|

11.2

|

Saturday, October 14, 2017

Weekly Review

There was no surprise in the market this week.

Earning season starts again! How fun!

Yes, it is a 5 figure profit. It's not my goal anyway. I enjoy it while it lasts.

Earning season starts again! How fun!

This week ES: 2539-2555.

Next week: 2540+/-5 pts - 2560+/-5pts

NQ should be above 6050.

Yes, it is a 5 figure profit. It's not my goal anyway. I enjoy it while it lasts.

Saturday, October 7, 2017

Weekly review

I didn't beat the market this week. I managed to collect several thousand dollar since I've been fighting with the trend.

My estimated range was

(2505 +/-5 pts --- 2520 +/-5 pts)

But the market was super strong. my upper range was pretty much served as the support. So I had to cut loss on the short position and I traded a lot this week as well.

Oh, Well. It's good that I didn't lose money. Hope that I can do better next week!

Next week!

(2530 +/-5 pts --- 2555 +/-5 pts)

Plan: If NQ has 40-50 points pull back, cut loss on NQ short.

Next Wednesday: Fed meeting minutes and ECB president talks on Thursday.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 22405.09 | 22773.67 | 368.58 | 1.6 | 15.2 |

| Nasdaq | 6495.96 | 6590.18 | 94.22 | 1.5 | 22.4 |

| S&P 500 | 2519.36 | 2549.33 | 29.97 | 1.2 | 13.9 |

| Russell 2000 | 1490.86 | 1510.23 | 19.37 | 1.3 | 11.3 |

Wednesday, October 4, 2017

Where are we now?

Vix: 9.83% up for two days.

Fear index: 92

ES range this week: 2517-2535.75

NQ range this week: 5978-6015.

NFP this Friday.

Fear index: 92

ES range this week: 2517-2535.75

NQ range this week: 5978-6015.

NFP this Friday.

Saturday, September 30, 2017

Historical performance

I encourage every my blog reader writes down his/her trading log. It actually helps me tremendously.

Good night. :-)

S&P 500 returns.

Data Source: Bloomberg SPXT Index

| 2017 (YTD) | 14.24% |

| 2016 | 11.96% |

| 2015 | 1.38% |

| 2014 | 13.69% |

| 2013 | 32.39% |

| 2012 | 16.00% |

| 2011 | 2.11% |

| 2010 | 15.06% |

| 2009 | 26.46% |

| 2008 | -37.00% |

| 2007 | 5.49% |

| 2006 | 15.79% |

| 2005 | 4.91% |

| 2004 | 10.88% |

| 2003 | 28.68% |

| 2002 | -22.10% |

| 2001 | -11.89% |

| 2000 | -9.10% |

| 1999 | 21.04% |

| 1998 | 28.58% |

| 1997 | 33.36% |

| 1996 | 22.96% |

| 1995 | 37.58% |

| 1994 | 1.32% |

| 1993 | 10.08% |

| 1992 | 7.62% |

| 1991 | 30.47% |

| 1990 | -3.10% |

| 1989 | 31.68% |

Weekly Review.

VIX is 9.51 and has been down for 4 days in a row.

CNN fear index: 85

CNN fear index: 85

SPX new high. It broke out my upper range.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 22349.59 | 22405.09 | 55.50 | 0.2 | 13.4 |

| Nasdaq | 6426.92 | 6495.96 | 69.04 | 1.1 | 20.7 |

| S&P 500 | 2502.22 | 2519.36 | 17.14 | 0.7 | 12.5 |

| Russell 2000 | 1450.78 | 1490.86 | 40.08 | 2.8 | 9.9 |

Friday, September 22, 2017

Weekly Review

My expected range is 2485-2505

The real range is 2492-2507

Next week: 2480-2510 I bet more on the down side.

I'm pretty happy with the YTD return. As I mentioned in the oldpost, I withdrew quite a few $$ from this account. Now the account is in Sync with the market.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 22268.34 | 22349.59 | 81.25 | 0.4 | 13.1 |

| Nasdaq | 6448.47 | 6426.92 | -21.55 | -0.3 | 19.4 |

| S&P 500 | 2500.23 | 2502.22 | 1.99 | 0.1 | 11.8 |

| Russell 2000 | 1431.71 | 1450.78 | 19.07 | 1.3 | 6.9 |

Wednesday, September 20, 2017

Where are we now?

It was kind of volatile today. But the range is still way too small. Stock trading gets boring and boring. :-) I just hold the position and haven't traded much this week.

The S&P is still very strong. ES is holding well above 2500. Let's give it couple days to see how strong the trend is. I would expect some pull back next week.

VIX: 9.78

The S&P is still very strong. ES is holding well above 2500. Let's give it couple days to see how strong the trend is. I would expect some pull back next week.

VIX: 9.78

Sunday, September 17, 2017

For your information.

Most people probably know it already. But it is nice to keep it in mind if you don't.

I posted this on my wall.

I posted this on my wall.

Friday, September 15, 2017

Weekly review.

I was expecting the market pulled back on Wednesday after the big rally on Tuesday. But it didn't stop. it kept going up. Tuesday's high 2485 pretty much acted like a support for the rest of the week. I was lucky to cut loss most of the short position on Wednesday and kept most of the long position.

I did very well this week.

Ok, what will happen next week?

"However, the Fed's massive balance sheet will be the focus of next week's FOMC meeting as it is widely expected that Fed Chair Janet Yellen will announce the start of a gradual reduction of assets bought in response to the 2008 financial crisis. The two-day FOMC meeting will kick off on Tuesday"

We'll see some weakness next Monday and Tuesday. I will use 2485 as support. the upper range set to 2505.

I speculate that the market will probably close lower than now, with vix 10.17. People are getting greedy. :-)

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 21797.79 | 22268.34 | 470.55 | 2.2 | 12.7 |

| Nasdaq | 6360.19 | 6448.47 | 88.28 | 1.4 | 19.8 |

| S&P 500 | 2461.43 | 2500.23 | 38.80 | 1.6 | 11.7 |

| Russell 2000 | 1399.43 | 1431.71 | 32.28 | 2.3 | 5.5 |

Saturday, September 9, 2017

Trading update and the speculation about the next week.

Normally I do some market review and examine my position on Saturday morning, although I haven't been posting that much.

I withdrew most of profit out at the end of July and am shopping for an investment property. Man, the market is so hot and we haven't had luck yet. But I don't want to pull the money back into the stock account. I will feel achieved if we actually get a house and it motivates me to make more money in the stock market.

I also opened a new trading account with Td Ameritrade and moved some money out of IB. I've not been very happy with interactive brokers since they charge way too many fees. So I'm pretty happy with my performance since I have much less money in IB now. I also started to make money in TD, but not much since I need to get familiar with its trading platform.

Ok, that's all the updates from me. I hope that you guys are making money as well!

The market pulled back on Friday since Hurrican Irma has bought a lot of fear and uncertainty. But if the damage is not that bad, the market will go higher next week. In my opinion, it will go higher next week. As a result, I added more long positions by the end of the trading day.

ES: 2445-2471. Close at 2462. (I will switch to use December contract next week). 17 points lower than last week's high. Actually it is not that bad.

If ES reaches 2445 area, I will be a buyer.

I withdrew most of profit out at the end of July and am shopping for an investment property. Man, the market is so hot and we haven't had luck yet. But I don't want to pull the money back into the stock account. I will feel achieved if we actually get a house and it motivates me to make more money in the stock market.

I also opened a new trading account with Td Ameritrade and moved some money out of IB. I've not been very happy with interactive brokers since they charge way too many fees. So I'm pretty happy with my performance since I have much less money in IB now. I also started to make money in TD, but not much since I need to get familiar with its trading platform.

Ok, that's all the updates from me. I hope that you guys are making money as well!

The market pulled back on Friday since Hurrican Irma has bought a lot of fear and uncertainty. But if the damage is not that bad, the market will go higher next week. In my opinion, it will go higher next week. As a result, I added more long positions by the end of the trading day.

ES: 2445-2471. Close at 2462. (I will switch to use December contract next week). 17 points lower than last week's high. Actually it is not that bad.

If ES reaches 2445 area, I will be a buyer.

Thursday, September 7, 2017

New Chapter of my life!

Check it out!

http://www.seattlesunrealestate.com

I still actively trade ES/NQ. But I just don't need that much time anymore. I have been using the same methodology since my first post back in 2012.

I got the real estate license two year ago but am getting very serious now!

Welcome to invest in Seattle properties, I can be the broker that you can count on!

http://www.seattlesunrealestate.com

I still actively trade ES/NQ. But I just don't need that much time anymore. I have been using the same methodology since my first post back in 2012.

I got the real estate license two year ago but am getting very serious now!

Welcome to invest in Seattle properties, I can be the broker that you can count on!

Monday, August 7, 2017

A quick notes about the market

1. This month low: ES:2410 on 7/11/17 NQ: 5650 on 7/10/17。

2. This month high: ES: 2480.5 NQ: 5995.75 on 7/27/17.

vix: 9.04--12.1 9.93 now.

Today: 2472-2478.

This week: 2460+/-5- 2480+/-5

Sunday, July 23, 2017

Next week!

Fed: Wednesday.

Action: buy any weakness before FED.

Whenever I have time, I've posted my real trade at

http://www.wenxuecity.com/groups/bbs.php?act=bbslist&gid=2861

I normally go back to the posts to re-live that moment and check out why I made those trades on the weekend.

Action: buy any weakness before FED.

Whenever I have time, I've posted my real trade at

http://www.wenxuecity.com/groups/bbs.php?act=bbslist&gid=2861

I normally go back to the posts to re-live that moment and check out why I made those trades on the weekend.

Sunday, July 16, 2017

Return Curve

Up and down, up and down. I don't really like it that much.

As a result, I withdrew most of the profit this year out. Hopefully I have a better chart for the next half a year. Maybe I will focus on position size more than trading itself.

As a result, I withdrew most of the profit this year out. Hopefully I have a better chart for the next half a year. Maybe I will focus on position size more than trading itself.

Tuesday, July 11, 2017

Yes! I did it!

Now ES: 25

NQ:15

I feel much better and I actually did the trade that I don't normally do!!! I normally can turn big profit to LOSS!! Some times it grows into bigger profit. I need to be fair. :-)

NQ:15

I feel much better and I actually did the trade that I don't normally do!!! I normally can turn big profit to LOSS!! Some times it grows into bigger profit. I need to be fair. :-)

Monday, July 10, 2017

I have a new stragety to protect the profit.

It's not easy to make money in the market. It has been volatile since I've held NQ position for the last month.

I've decided to reduce the position after weekly profit exceeds 10K. I really have a hard time to book the profit and that is why I'm writing this. I might need to put it in ACTION tomorrow.

I will be holding around 20 ES/14 NQ tomorrow. OK! Let's do it!!!!!!!!

I've decided to reduce the position after weekly profit exceeds 10K. I really have a hard time to book the profit and that is why I'm writing this. I might need to put it in ACTION tomorrow.

I will be holding around 20 ES/14 NQ tomorrow. OK! Let's do it!!!!!!!!

Friday, July 7, 2017

No more ZB future

I've lost a lot of money on ZB future in a month. I was winning in the beginning and held it into a big loss.

Ok, I will never never try anything new from now on!

I will just play the old ES/NQ.

Ok, I will never never try anything new from now on!

I will just play the old ES/NQ.

Friday, June 30, 2017

End of the first half year

- Nasdaq Composite +14.1% YTD

- S&P 500 +8.2% YTD

- Dow Jones Industrial Average +8.0% YTD

- Russell 2000 +4.3% YTD

I did better than overall market. But I really need to work on my position size.

Friday, June 23, 2017

6/23/17 Weekly update

- Nasdaq Composite +16.4% YTD

- S&P 500 +8.9% YTD

- Dow Jones Industrial Average +8.3% YTD

- Russell 2000 +4.3% YTD

I've recovered the lost on 5/18/17 and made more. The balance is at the highest YTD.

I feel like that the market will pull back next week. I will do more analysis once I have time this weekend.

Sunday, June 18, 2017

This week's event.

SPX500 future range: 2420+/-5 -2450+/-5pts. I'm bullish towards next week.

NQ range: 5600 as support and 5750 as the upper range.

NQ range: 5600 as support and 5750 as the upper range.

Sunday, June 4, 2017

Saturday, June 3, 2017

Weekly summary

- Nasdaq Composite +17.1% YTD

- S&P 500 +8.9% YTD

- Dow Jones Industrial Average +7.3% YTD

- Russell 2000 +3.6% YTD

- I did good this week.

Sunday, May 28, 2017

Weekly Summary

A good week. I've been very careful about the market. I'm good at spotting the rally at the early stage and it also contributed my gain.The price that I bought at ES this week is 2398, 2401 and 2407.

Wednesday, May 24, 2017

On the path to recover -- Day 3

I'm still thinking why the heck I've lost that much last week. I really need to do some homework to analyze myself.

Tuesday, May 23, 2017

On the path to recover -- Day 2

Nah, I'm not counting anymore after this. I know I will be doing good if I'm careful. I don't care whether I will recover or not. I will remind myself to be cautious ALL THE TIME!

Monday, May 22, 2017

Saturday, May 20, 2017

Weekly review

I hope that I'm done with the mistake this year.

Thursday, May 18, 2017

I blew up a big profit yesterday and today.

Can I avoid it? I've pretty much traded for nothing since 4/18/17.

11% loss.

11% loss.

Monday, May 15, 2017

5/15/17 Monday

So far it's still within the range I defined. I plan to add 5 short position tomorrow.

- Nasdaq Composite +14.2% YTD

- S&P 500 +7.3% YTD

- Dow Jones Industrial Average +6.2% YTD

- Russell 2000 +2.7% YTD

- Oil up

- Vix:10.42

Sunday, May 14, 2017

Saturday, May 13, 2017

I'm a real estate agent in Seattle.

By the way, you know that I'm a software engineer beside trading stocks/futures if you read my blog long enough. Probably you don't know that I've been a real estate agent in Seattle for the last two years as a part time job. :-)

I've been living in the city for more than 17 years. If you want to buy an investment property in this area, please feel free to leave comments or email me at judyshw@gmail.com.

Seattle is a great place to invest. Houses are cheaper than its neighbor Vancouver and San Fransisco and has a great potential since there are so many high tech companies that move here. The value of my own investment properties goes up a lot and still has the potential to increase more.

I've been living in the city for more than 17 years. If you want to buy an investment property in this area, please feel free to leave comments or email me at judyshw@gmail.com.

Seattle is a great place to invest. Houses are cheaper than its neighbor Vancouver and San Fransisco and has a great potential since there are so many high tech companies that move here. The value of my own investment properties goes up a lot and still has the potential to increase more.

5/13/17 Saturday Weekly review

Weekly review. The market is slightly down. But I did pretty well. More review and plan later.

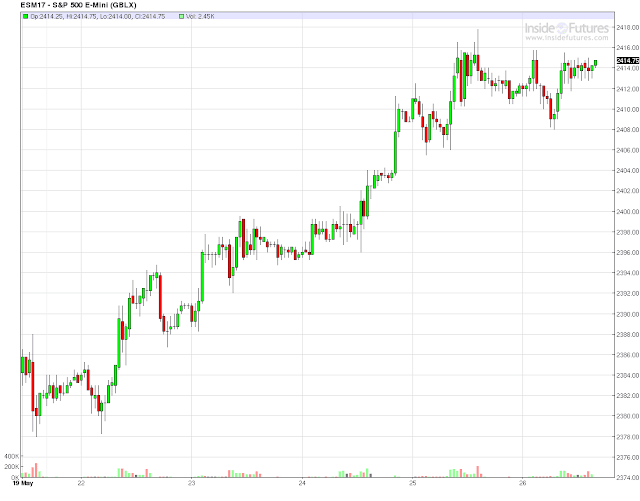

What did you see from the following two charts?

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 21006.94 | 20896.61 | -110.33 | -0.5 | 5.7 |

| Nasdaq | 6100.76 | 6121.23 | 20.47 | 0.3 | 13.7 |

| S&P 500 | 2399.29 | 2390.90 | -8.39 | -0.3 | 6.8 |

| Russell 2000 | 1397.00 | 1382.77 | -14.23 | -1.0 | 1.9 |

Wednesday, May 10, 2017

5/10/17 Wednesday, another flat boring day!

- Nasdaq Composite +13.9% YTD

- S&P 500 +7.2% YTD

- Dow Jones Industrial Average +6.0% YTD

- Russell 2000 +3.1% YTD

- Vix: 10.21

- I do feel that money comes from trees for now. I will enjoy it while it lasts.

Tuesday, May 9, 2017

5/9/17 Tuesday FLAT again!

- Nasdaq Composite +13.7% YTD

- S&P 500 +7.1% YTD

- Dow Jones Industrial Average +6.1% YTD

- Russell 2000 +2.6% YTD

- Not much to say. I didn't pay much to the market since it is not moving at all. I've hold most of the position and added some long position early this morning!

Monday, May 8, 2017

5/8/17 Monday FLAT

- Nasdaq Composite +13.4% YTD

- S&P 500 +7.2% YTD

- Dow Jones Industrial Average +6.3% YTD

- Russell 2000 +2.5% YTD

- VIX:9.77. -7.57%--- no surprise in French Election.

Sunday, May 7, 2017

Next week!

We would like to check out the impact of French Election tonight. There maybe not much.

The next week range:

SPX future. (ESM17): 2380+-/5 -- 2400+/-5 pts. I'm hoping to see a bigger range. We'll see.

I need to reduce some long position on Monday either way.

The next week range:

SPX future. (ESM17): 2380+-/5 -- 2400+/-5 pts. I'm hoping to see a bigger range. We'll see.

I need to reduce some long position on Monday either way.

Saturday, May 6, 2017

I normally follow my plans.

Here is the PL for this week.:

Monday:

Added some short positions.

Tuesday:

Added NQ positions.

Wednesday:

Added NQ positions.

Thursday:

Added ES long position to hedge the short position.

Friday:

I planned to do nothing if spx future was settled around 2390. But I had to cut and readjust the short position around 11am-->12am PST since I saw the market consolidated without any weak sign. French election on Sunday is another reason for me to readjust the position.

SPX future was last traded at 2399!

Some pps ask me how I trade and why I make money.

I normally follow my plans.

Here is one example:

http://babysunfuture.blogspot.com/2017/04/next-week.html

Monday:

Added some short positions.

Tuesday:

Added NQ positions.

Wednesday:

Added NQ positions.

Thursday:

Added ES long position to hedge the short position.

Friday:

I planned to do nothing if spx future was settled around 2390. But I had to cut and readjust the short position around 11am-->12am PST since I saw the market consolidated without any weak sign. French election on Sunday is another reason for me to readjust the position.

SPX future was last traded at 2399!

Some pps ask me how I trade and why I make money.

I normally follow my plans.

Here is one example:

http://babysunfuture.blogspot.com/2017/04/next-week.html

Friday, May 5, 2017

Weekly Review

From Briefing:

Week In Review: Flat & Happy

The S&P 500 opened the week by eking out back-to-back wins. Monday's marginal victory was fueled by the top-weighted technology and financials sectors while Tuesday's uptick took place despite the lack of sector leadership and crude oil's 2.5% decline. On the political front, Congress reached an agreement to keep the government funded through September while President Trump reiterated that he might like to break up the nation's biggest banks.

On Wednesday, the benchmark index registered its first, and only, loss of the week (-0.1%) after Apple (AAPL) reported lower than expected iPhone unit sales. However, the tech giant's upbeat earnings kept losses in check. The FOMC voted to leave the fed funds target range unchanged at 0.75%-1.00%, as expected, with the accompanying policy statement providing little to no new information.

The House of Representatives passed the revised American Health Care Act on Thursday, a big victory for the GOP. However, the bill will face heavy resistance in the Senate, where it can only afford to lose two Republican votes. Crude oil also made headlines, plunging 4.7% to a five-month low near $45.50/bbl. The tumble was credited to a string of disappointing inventory reports, some weak data out of China, and the deteriorating technical picture for the commodity. The S&P 500 added 0.1%.

Buyers were intrigued by Friday's better than expected Employment Situation Report for April, however, gains were capped once again ahead of the final round of the French presidential election, which will take place on Sunday. Polls suggest that Emmanuel Macron will easily defeat his rival Marine Le Pen, which has been construed as a positive for global equity markets given Ms. Le Pen's anti-EU rhetoric. France's CAC ended the week at its highest level in over ten years.

In the end, despite the range-bound action, this week will be remembered as a happy one with the S&P 500 advancing for the fourth week in a row, adding 0.6%. The fed funds futures market still points to the June FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 83.1%, up from last week's 66.6%.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 20940.51 | 21006.94 | 66.43 | 0.3 | 6.3 |

| Nasdaq | 6047.61 | 6100.76 | 53.15 | 0.9 | 13.3 |

| S&P 500 | 2384.20 | 2399.29 | 15.09 | 0.6 | 7.2 |

| Russell 2000 | 1400.43 | 1397.00 | -3.43 | -0.2 | 2.9 |

I did much better than the indices return. I will post more later this week.

Subscribe to:

Posts (Atom)

Hello, Everyone!

I've become a very mature trader after trading in the stock market for 12 years. I've been very focus and only trade E-min futures a...

-

Come to meet me. :-) I decide to open a twitter account using this photo. It was taken yesterday Name? Babysun if it is still available...

-

So is my account balance. Index Started Week Ended Week Change % Change YTD % DJIA 26071.72 26616.71 544.99 2.1 7.7 Nasdaq 7336.38 ...