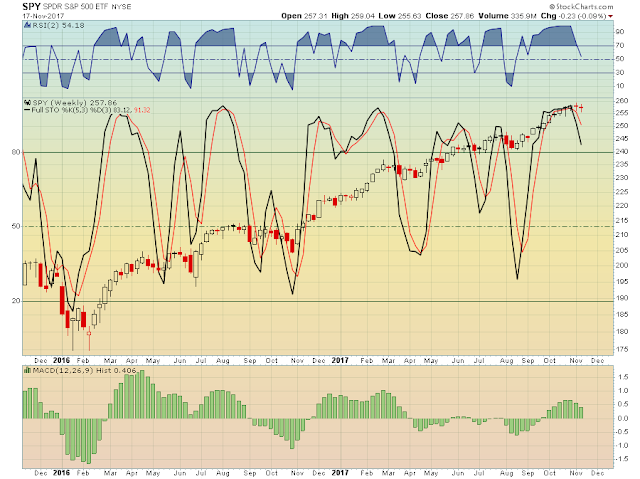

Although ES tried sever time above 2600, I'm not sure whether it will stay. It was a holiday week and the market tended to do the fake breakout. We'll see where the real market attention is next couple weeks. But no matter what, I don't see big pull back either.

I'm prepared either way. I will not jump to trade for the new fund available in TD. I will patiently wait that there is at least 14+ points move in SPX.

Trade Range for the past week: 2568-2603

The expect trading range is 2585+/5-2605+/-5

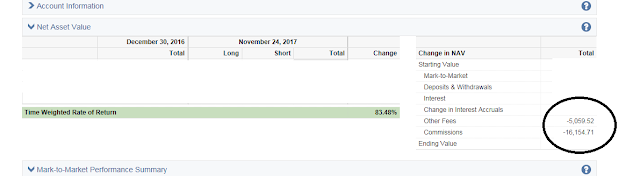

From the picture I posted, you can see that I've contributed to IB quite a bit. Hopefully I can see the difference from TD next year.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 23358.24 | 23557.99 | 199.75 | 0.9 | 19.2 |

| Nasdaq | 6782.79 | 6889.16 | 106.37 | 1.6 | 28.0 |

| S&P 500 | 2578.85 | 2602.42 | 23.57 | 0.9 | 16.2 |

| Russell 2000 | 1492.82 | 1519.16 | 26.34 | 1.8 | 11.9 |