I normally do this on Saturday but we went to skiing yesterday. So here you go.

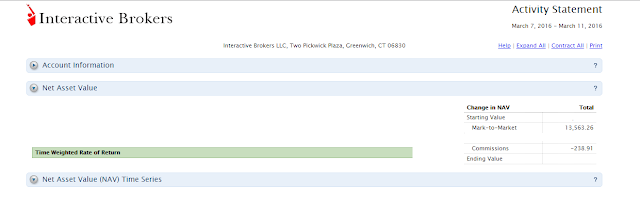

I didn't trade much as planned. The commission was even less than half of the previous week. Oh, well. It is still a positive week.

I'm ambitious again and want to make money next week. :-)

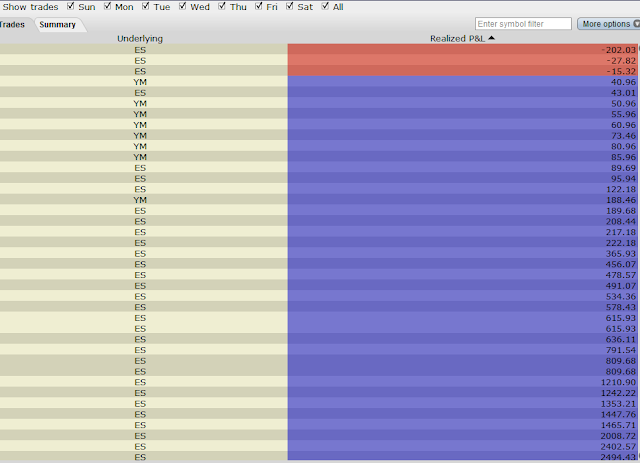

As you've probably already seen that I never get the perfect entry for the long or short position, but I could make it work most of time.

Sunday, March 27, 2016

Saturday, March 26, 2016

Next week trading plans and thoughts.

RANGE: 2020+/-5 PTS -2055+/- 5 PTS.

The market probably rallies hard on Monday. I would sell covered calls in the last hour if it happens. But if I have more than 5K paper profit, I will realize all and rebuild new positions in the last hour.

I expect that the market goes higher next week. But I will always be prepared if my speculation is wrong.

The market probably rallies hard on Monday. I would sell covered calls in the last hour if it happens. But if I have more than 5K paper profit, I will realize all and rebuild new positions in the last hour.

I expect that the market goes higher next week. But I will always be prepared if my speculation is wrong.

Friday, March 25, 2016

3/25/16 Friday Weekly Review

A short week. I have another winning week.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 17599.42 | 17515.73 | -83.69 | -0.5 | 0.5 |

| Nasdaq | 4795.65 | 4773.50 | -22.15 | -0.5 | -4.7 |

| S&P 500 | 2049.50 | 2035.94 | -13.56 | -0.7 | -0.4 |

| Russell 2000 | 1101.67 | 1075.10 | -26.57 | -2.4 | -5.4 |

Saturday, March 19, 2016

Take a break.

I don't want to force myself to make 10K per week. I have been purely lucky recently. As a result, I'm taking a break and will be busy with some other things instead of the stock market. (Cool down a little).

3/19/16 Saturday Weekly review.

All of my comments that relate to the trading from the last week:

Guess the trading range.

Hope the market can pull back a bit at 8:30am on Monday

Finally, the pull back on Tuesday

Reduce the position before FOMC

Add the position back after FOMC

Added the position for the short term play(for Thirsday and Friday)

More to come. As I said, I will not post the P&L going forward. I still will summarize the trades and the market views.

Notes:

1. Be sure to adjust the positions in the last hour of the trading session, especially when there are important events. Check on what happened on Thursday, Mar 17th! The price was a lot better in the last hour. I need to pay attention to the time frame from 8:am to 8:30am.

2. What did I do on Tuesday? What could I have done better next time?

Event last week:

Guess the trading range.

Hope the market can pull back a bit at 8:30am on Monday

Finally, the pull back on Tuesday

Reduce the position before FOMC

Add the position back after FOMC

Added the position for the short term play(for Thirsday and Friday)

More to come. As I said, I will not post the P&L going forward. I still will summarize the trades and the market views.

Notes:

1. Be sure to adjust the positions in the last hour of the trading session, especially when there are important events. Check on what happened on Thursday, Mar 17th! The price was a lot better in the last hour. I need to pay attention to the time frame from 8:am to 8:30am.

2. What did I do on Tuesday? What could I have done better next time?

Event last week:

Friday, March 18, 2016

3/18/16 Friday

I will post my P&L this week tomorrow. But it will be the last time I post the result since it is not helping me mentally.

Pull back is on the way?

Pull back is on the way?

Wednesday, March 16, 2016

3/16/16 Wed update

I did pretty good again. I pretty much executed the trade that I planned last night. I cut loss on VIX and reduced the position before FOMC.

I added more positions in the last hour. I expect that I will get more money by the end of the week.

I added more positions in the last hour. I expect that I will get more money by the end of the week.

Tuesday, March 15, 2016

3/15/16 Tuesday update

I changed my mind.

Yup, the profit might be gone by the end of the week or I can double the profit.

Yup, the profit might be gone by the end of the week or I can double the profit.

Monday, March 14, 2016

3/14/16 Monday update

I didn't sleep well due the time change and I just got up. I covered one short at 2015.5 now and I cut loss on 1 VIX call also.

I still need to wait and hope that the market can move up or down a little more so that I can take another action.

I will concentrate on doing my work until then.

I still need to wait and hope that the market can move up or down a little more so that I can take another action.

I will concentrate on doing my work until then.

Friday, March 11, 2016

Trade anaylsis and Next week.

I did well this week. I don't make this kinda of money from my daily work. I will spend more time to analyze my trade. Yes, I will keep the money. It is much more important than making money.

I thought about closing everything on Monday after I had 2.8K profit. Anyway, I got lucky this time.

TODOs:

1. What should I do with the position in hand? There is FOMC on Wednesday and Quadruple Witching on Friday. I need to be careful about Friday.

2. Review all my past trading record for the third week of March and find the weakness.

3. Review last 10 weeks trade record on Friday.

4. Review the trade and my thought for the last week. For instance, I planned to book the profit at the early morning on Friday on Thursday. But I booked the profit and continued chasing the trend.

What was I thinking? What happened on Thursday?

5. More exercises and Starbucks.

Tuesday, March 8, 2016

3/8/16 Tuesday

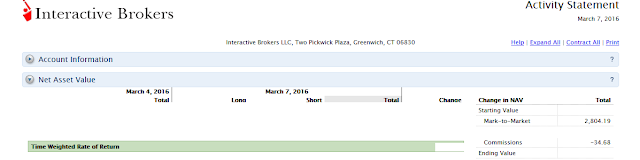

I bought 1 ES at 1978

Update at 9:15am: Out 1 ES at 1989.25/

Here is the report from yesterday. I don't know whether I still have that much profit by the end of the week.

Update at 9:15am: Out 1 ES at 1989.25/

Here is the report from yesterday. I don't know whether I still have that much profit by the end of the week.

Monday, March 7, 2016

3/7/16 Monday update

Range: 1,984-1997.So far so good.

I increased the buying power by buying some really out of money options. It is necessary for me to hold the position peacefully. It is called the insurance money.

Updated at 10:30am:

I like this kind of market. It is slow and the range is small and I don't need to do anything right now.

Range: 1984--2004

I increased the buying power by buying some really out of money options. It is necessary for me to hold the position peacefully. It is called the insurance money.

Updated at 10:30am:

I like this kind of market. It is slow and the range is small and I don't need to do anything right now.

Range: 1984--2004

Sunday, March 6, 2016

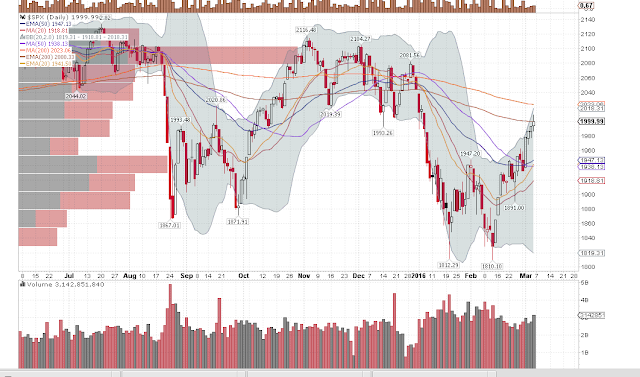

Trade anaylsis and Next week.

I'm actually learning from myself. I put the mistake I made two weeks ago behind me.

The last week range: 1920---2007.

I'm expecting the range will be pretty small for the next 5 days.

My current positions will generate the max profit if ES is between (1988 --- 2010)

I started with 1960p-1930 bull put and 1960C -1990C Bear Call spread and some ES last week I did very well by cutting loss of the bear spread at the very early stage. But the commission is high.

By the way, earning season often starts with AA and ends with WMT.

The comments that I made after I traded.

http://bbs.wenxuecity.com/finance/3982742.html

http://bbs.wenxuecity.com/finance/3982649.html

http://bbs.wenxuecity.com/finance/3982698.html I've unrealized loss in the vix position right now.

http://bbs.wenxuecity.com/finance/3983371.html

http://bbs.wenxuecity.com/finance/3985098.html

The last week range: 1920---2007.

I'm expecting the range will be pretty small for the next 5 days.

My current positions will generate the max profit if ES is between (1988 --- 2010)

I started with 1960p-1930 bull put and 1960C -1990C Bear Call spread and some ES last week I did very well by cutting loss of the bear spread at the very early stage. But the commission is high.

By the way, earning season often starts with AA and ends with WMT.

The comments that I made after I traded.

http://bbs.wenxuecity.com/finance/3982742.html

http://bbs.wenxuecity.com/finance/3982649.html

http://bbs.wenxuecity.com/finance/3982698.html I've unrealized loss in the vix position right now.

http://bbs.wenxuecity.com/finance/3983371.html

http://bbs.wenxuecity.com/finance/3985098.html

Subscribe to:

Posts (Atom)

Hello, Everyone!

I've become a very mature trader after trading in the stock market for 12 years. I've been very focus and only trade E-min futures a...

-

Come to meet me. :-) I decide to open a twitter account using this photo. It was taken yesterday Name? Babysun if it is still available...

-

So is my account balance. Index Started Week Ended Week Change % Change YTD % DJIA 26071.72 26616.71 544.99 2.1 7.7 Nasdaq 7336.38 ...