2365+/-5 pts ---> 2395+/-5pts

May add more NQs next week.

Saturday, April 29, 2017

Friday, April 28, 2017

4/29/17 Saturday Weekly summary

I've changed some trading habit this week.

I've started to review the trading record and the contract size for several minutes every night.

I've talked loudly about my thoughts.

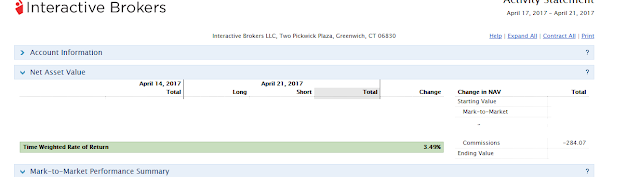

As a result, I've been doing very well. It's the second best week for me this year. ( I held bunch of short position when this week started. I thought that the market might sell off in the last week of April. :-) I acted quickly so that I was in sync with the market.)

Remember last Sunday? The future gaped up and the force was strong. I went to buy long position after 10 minutes of the opening. The future still held on Sunday night and I didn't wait and see. I analyzed all of the short position I had, I did calculate how to cut loss and how to change the position. (I was holding more short position than longs over the weekend.)

I did exactly what I've planned when I woke up on Monday. (I cut down the half of the short position but I added some back later by the end of the trading session).

The market was running high again on Tuesday. I cut down all the short position out of frustration and reentered and readjusted it later.

The market was back normal for the rest of the week and I'm more used to it. :-)

I've started to review the trading record and the contract size for several minutes every night.

I've talked loudly about my thoughts.

As a result, I've been doing very well. It's the second best week for me this year. ( I held bunch of short position when this week started. I thought that the market might sell off in the last week of April. :-) I acted quickly so that I was in sync with the market.)

Remember last Sunday? The future gaped up and the force was strong. I went to buy long position after 10 minutes of the opening. The future still held on Sunday night and I didn't wait and see. I analyzed all of the short position I had, I did calculate how to cut loss and how to change the position. (I was holding more short position than longs over the weekend.)

I did exactly what I've planned when I woke up on Monday. (I cut down the half of the short position but I added some back later by the end of the trading session).

The market was running high again on Tuesday. I cut down all the short position out of frustration and reentered and readjusted it later.

The market was back normal for the rest of the week and I'm more used to it. :-)

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 20547.76 | 20940.51 | 392.75 | 1.9 | 6.0 |

| Nasdaq | 5910.52 | 6047.61 | 137.09 | 2.3 | 12.3 |

| S&P 500 | 2348.69 | 2384.20 | 35.51 | 1.5 | 6.5 |

| Russell 2000 | 1379.85 | 1400.43 | 20.58 | 1.5 | 3.2 |

4/28/17 Friday

- Nasdaq Composite +12.3% YTD

- S&P 500 +6.5% YTD

- Dow Jones Industrial Average +6.0% YTD

- Russell 2000 +3.2% YTD

- Minor pull-back.

Thursday, April 27, 2017

4/27/17 Thursday

- Nasdaq Composite +12.4% YTD

- S&P 500 +6.7% YTD

- Dow Jones Industrial Average +6.2% YTD

- Russell 2000 +4.4% YTD

- GOOG + AMZN. Good ER. MSFT+INTC missed

- Not that important, but just FYI

"On Friday, investors will receive another sizable batch of economic reports, including the advance estimate of first quarter GDP at 8:30 ET, April Chicago PMI at 9:45 ET, and the final reading of the University of Michigan Consumer Sentiment Index for April at 10:00 ET."

Wednesday, April 26, 2017

4/26/17 Wednesday

- Nasdaq Composite +11.9% YTD

- S&P 500 +6.6% YTD

- Dow Jones Industrial Average +6.1% YTD

- Russell 2000 +4.6% YTD

- Consolidation day.

Tuesday, April 25, 2017

4/25/17 Tuesday

- Nasdaq Composite +11.9% YTD

- S&P 500 +6.7% YTD

- Dow Jones Industrial Average +6.2% YTD

- Russell 2000 +4.0% YTD

Monday, April 24, 2017

4/24/17 Monday Strong trend up

- Nasdaq Composite +11.2% YTD

- S&P 500 +6.0% YTD

- Dow Jones Industrial Average +5.1% YTD

- Russell 2000 +3.0% YTD

- vix: 10.84 down 25% from last Friday.

- Normally I jumped in early in the strong trend day. (Cut short and added long. I've made a lot of money today). As a result. The account balance is at the highest for the year.

- SPX is going to be traded in a new range. I use ES 2365 as support for now.

Saturday, April 22, 2017

Weekly summary

What have I done good?

- I've been holding NQs firmly.

- Position size is controlled pretty well.

What do I need to pay attention?

Tuesday's high > Wednesday's low?

Thursday's high > Tuesday's high?

Continuing paying attention to the position size.

What should I avoid?

I was hoping that ES was closed above 2350 on Thursday. But it didn't. I ended up giving a couple ground back.

There are too many open positions on Thursday after the strong trend day and the result is not GOOD either!

Try not to jump to trade in the first hour unless it is a strong trend day.

Friday, April 21, 2017

4/21/17 Friday

- Nasdaq Composite +9.8% YTD

- S&P 500 +4.9% YTD

- Dow Jones Industrial Average +4.0% YTD

- Russell 2000 +1.7% YTD

- vix: 14.63

Thursday, April 20, 2017

4/20/17 Thursday

The trade is easy today: chase high.

"Thursday's bullish mentality was helped by the latest reports from Washington, which suggested that the Freedom Caucus, the group credited with blocking the GOP's first attempt at health care reform, is now on the same page with Republican leadership in repealing and replacing the Affordable Care Act. This is positive news for investors as progress on health care reform equates to progress on tax reform with President Trump making it clear that the two pieces of legislation will be done in that order. In addition, Treasury Secretary Steven Mnuchin said that the White House will release a major tax reform plan "very soon.""

I would expect that ES close above 2350 tomorrow.

- Nasdaq Composite +9.9% YTD

- S&P 500 +5.2% YTD

- Dow Jones Industrial Average +4.1% YTD

- Russell 2000 +2.0% YTD

"Thursday's bullish mentality was helped by the latest reports from Washington, which suggested that the Freedom Caucus, the group credited with blocking the GOP's first attempt at health care reform, is now on the same page with Republican leadership in repealing and replacing the Affordable Care Act. This is positive news for investors as progress on health care reform equates to progress on tax reform with President Trump making it clear that the two pieces of legislation will be done in that order. In addition, Treasury Secretary Steven Mnuchin said that the White House will release a major tax reform plan "very soon.""

I would expect that ES close above 2350 tomorrow.

Wednesday, April 19, 2017

4/19/17 Wednesday.

- Nasdaq Composite +8.9% YTD

- S&P 500 +4.4% YTD

- Dow Jones Industrial Average +3.3% YTD

- Russell 2000 +0.7% YTD

Tuesday, April 18, 2017

Back

I was on vacation and had no access to the blogger.

Here we go for this week:

Here we go for this week:

For the week ending 13 April 2017

- Trump may nominate Yellen to second term

- Geopolitical tensions rise

- Four candidates in French presidential mix

- Fed chair: Economy healthy now

- Canadian central bank head warns on house prices

Global equities dipped this week with the intensification of geopolitical jitters over rising tensions on the Korean peninsula and the possibility of a stronger US commitment to oust Syria’s Russian-backed leader Bashar al-Assad. A safe-haven bid pushed the yield on the US 10-year Treasury note down to its lowest point of the year at 2.25%. Oil prices continued their rebound, with West Texas Intermediate crude rising to $53.25 from $52 a week ago. Volatility, as measured by the Chicago Board Options Exchange Volatility index, jumped to 16 from 12.8 last week.

GLOBAL MACRO NEWS

Trump shifts toneUS president Donald Trump sounded decidedly more moderate than he did during last fall’s campaign in an interview with the Wall Street Journal on Wednesday. The president reversed course on multiple fronts. First, Trump said he may nominate US Federal Reserve Board chair Janet Yellen to a second term after saying last fall that she was "toast" and he would replace her at the end of her term. He also reversed his opposition to the US Export-Import Bank, which finances US exports. Critics cite the bank as an example of “corporate welfare.” Additionally, the president shifted gears on NATO, saying the alliance is no longer obsolete because it has begun to fight terrorism. Finally, Trump said the United States will not label China a currency manipulator, thus breaking another campaign vow. The reversal may represent an attempt to entice China to increase pressure on North Korea to abandon its nuclear program.

North Korea, Syria in spotlightTensions continued to mount on the Korean peninsula as the North Korean regime threatened a nuclear strike in response to any US aggression. North Korea is believed to be trying to develop intercontinental ballistic missiles capable of reaching the US mainland. This week, the US navy dispatched a carrier task force to the western Pacific in a show of force, while Chinese president Xi Jinping said that China is committed to the denuclearization of the Korean peninsula. President Trump called on China to do more to rein in its nuclear-armed neighbor, saying if China won’t help, the US could act alone. Meanwhile, the US and other G7 nations continue to pressure Russia to abandon its support of Syria’s Bashar al-Assad in the wake of last week’s chemical weapons attack on Syrian rebels which led to a cruise missile strike on a Syrian airbase by US forces.

Four contenders vie for two spots in French runoffFor months, there have been three candidates in contention for the two spots in the second round of the French presidential election. Marine Le Pen, the populist firebrand, has consistently led recent polls, trailed closely by centrist Emmanuel Macron. François Fillon, hampered by an ethics scandal, has held the third position most of the time. Now a fourth candidate, leftist Jean-Luc Mélenchon, has entered the fray and is in a virtual tie for third place with Fillon. The conventional wisdom is that Le Pen will be beaten handily in the second round by either Macron or Fillon, who are more centrist. But the emergence of Mélenchon could put an unexpected wrinkle into the process. First-round voting takes place on 23 April.

Yellen: Fed allowing economy to coastSpeaking at the University of Michigan, Fed chair Yellen said that the US economy is healthy and that the Fed is now shifting its focus, taking its foot off the accelerator and allowing the economy to “coast” for a while, saying a gradual path of interest rate increases can get us where we need to go. Yellen also opined on several bills that are working their way through Congress, expressing concern that the Fed could become subject to political pressure if the bills are signed into law.

Poloz: House prices can go down as well as upBank of Canada governor Stephen Poloz warned of the growing role of speculation in the recent acceleration in Toronto-area house prices. The central banker said that prices had accelerated from percentages in the high teens to the 30% zone, adding there is no fundamental story that can explain the rise. “I think it is timely to remind folks that prices of houses can go down as well as up,” he said. Poloz also said that further rate cuts in Canada are no longer on the table.

EM debt issuance boomed in Q1Borrowers in emerging markets raised a record $181 billion during the first quarter of the year. Corporates raised $119.1 billion, beating the Q1 2013 record, while sovereigns raised $61.5 billion, topping the year-ago quarter by over $16 billion, according to data from J.P. Morgan. Total emerging market debt rose to $55 trillion in 2016, equal to 215% of the collective GDP of emerging nations.

| Index | Thursday’s Close |

Week’s Change |

% Change YTD |

| DJIA |

20453.25 |

-202.85 |

3.49% |

| S&P 500 |

2328.95 |

-26.59 |

4.03% |

| Nasdaq Composite |

5805.15 |

-72.66 |

7.84% |

| S&P MidCap 400 |

1682.71 |

-24.71 |

1.43% |

| Russell 2000 |

1346.73 |

-18.79 |

-0.64% |

THE WEEK AHEAD

- China reports GDP, retail sales and industrial production on Monday, 17 April

- The United States releases industrial production data on Tuesday, 18 April

- The eurozone releases its consumer price index on Wednesday, 19 April

- The Fed’s Beige Book is published on Wednesday, 19 April

- The United Kingdom reports retail sales data on Friday, 21 April

- US existing home sales data are released on Friday, 21 April

Saturday, April 1, 2017

my my my! The quarter is over..

Hopefully I can do better next quarter!

Next week:

The Stock & Bond Market

| Index | Close | Week | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 20,663 | 0.3% | 4.6% |

| S&P 500 Index | 2,363 | 0.8% | 5.5% |

| NASDAQ | 5,912 | 1.4% | 9.8% |

| Bonds* | $108.49 | 0.1% | 0.8% |

| 10-yr Treasury Yield | 2.39% | -0.02% | -0.06% |

| Oil ($/bbl) | $50.74 | 5.8% | -5.5% |

Weekly Review - A good week

ES: 2318-2367.

It could be a record since I never traded that much before. Anyway, I cut loss on Sunday afternoon in order to have a good sleep. I reopened the position around ES 2322/NQ5322 on Monday.

I was not sure what would happened and bought some short position on early Tuesday. The market rallied and I cut short and chased high. The Naz outperformed on Wednesday and I benefited a lot from it.

I did load more long position on Thursday which I regret it later on . Unfortunately I was greedy yesterday by holding them for more money into the closing. Oh, well. I learned my lesson.

It could be a record since I never traded that much before. Anyway, I cut loss on Sunday afternoon in order to have a good sleep. I reopened the position around ES 2322/NQ5322 on Monday.

I was not sure what would happened and bought some short position on early Tuesday. The market rallied and I cut short and chased high. The Naz outperformed on Wednesday and I benefited a lot from it.

I did load more long position on Thursday which I regret it later on . Unfortunately I was greedy yesterday by holding them for more money into the closing. Oh, well. I learned my lesson.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 20596.72 | 20663.22 | 66.50 | 0.3 | 4.6 |

| Nasdaq | 5828.74 | 5911.74 | 83.00 | 1.4 | 9.8 |

| S&P 500 | 2343.98 | 2362.72 | 18.74 | 0.8 | 5.5 |

| Russell 2000 | 1355.13 | 1385.78 | 30.65 | 2.3 | 2.1 |

I have decided that the number is below 200 over the weekend and below 250 on the weekdays.

Subscribe to:

Comments (Atom)

Hello, Everyone!

I've become a very mature trader after trading in the stock market for 12 years. I've been very focus and only trade E-min futures a...

-

is very simple. I've realized one key thing in trading success after being through earlier this year is to keep it to yourself. I usua...

-

I have been bullish for several weeks and I started with the neutral position and I cut loss on the short position during the week last wee...

-

I've become a very mature trader after trading in the stock market for 12 years. I've been very focus and only trade E-min futures a...