It was a right decision.

Monday, November 30, 2015

Sunday, November 29, 2015

Why the stock market is so attractive.

It is a pretty much one-man job that I don't need to deal with people. On the other hand, a lot of other jobs we need to interact with people. When I like to be alone, checking out my old trading notes is fun.

It is a place where I keep improving myself. Making money in the market secures my current job. There have been so many lay-offs in the company, I've survived each time since I was not really afraid if I got laid off. I finish my job fine with this mind set. Having a steady job helps me to make money in the market. I'm independent and I can waste some money if I want. I spent a lot over the past weekend to shop the stuff that I actually don't need. :-)

That is it for now. I need to cook lunch.

It is a place where I keep improving myself. Making money in the market secures my current job. There have been so many lay-offs in the company, I've survived each time since I was not really afraid if I got laid off. I finish my job fine with this mind set. Having a steady job helps me to make money in the market. I'm independent and I can waste some money if I want. I spent a lot over the past weekend to shop the stuff that I actually don't need. :-)

That is it for now. I need to cook lunch.

Saturday, November 28, 2015

Come Come Come.

Come to meet me. :-) I decide to open a twitter account using this photo. It was taken yesterday

Name? Babysun if it is still available.

For the last week, I followed the plan and reduced some position yesterday. Yup, the market has been so flat for the week. I reduced the short position after the Turkey's airplane news and switched to long later on the same day and held all until yesterday.

I expect that the market will pull back starting the week of Dec 7th. But who knows? My positions are neutral now. Let's see how I'm doing next week.

Name? Babysun if it is still available.

For the last week, I followed the plan and reduced some position yesterday. Yup, the market has been so flat for the week. I reduced the short position after the Turkey's airplane news and switched to long later on the same day and held all until yesterday.

I expect that the market will pull back starting the week of Dec 7th. But who knows? My positions are neutral now. Let's see how I'm doing next week.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 17823.81 | 17798.49 | -25.32 | -0.1 | -0.1 |

| Nasdaq | 5104.92 | 5127.52 | 22.60 | 0.4 | 8.3 |

| S&P 500 | 2089.17 | 2090.11 | 0.94 | 0.0 | 1.5 |

| Russell 2000 | 1175.13 | 1202.38 | 27.25 | 2.3 | -0.2 |

Friday, November 27, 2015

Shopping...

I did some shopping from Amazon. But I still want to go to stores to check out. I do need to do some adjustment for my positions later today.

Thursday, November 26, 2015

Black Friday and Stock market.

What do I think of it?

I've had over 6K profit (on the paper) for the last several days.

If the market rallies tomorrow, it doesn't mean anything.

I will book the profit and add short positions.

That is my trader's mindset.

http://www.marketwatch.com/story/what-stock-investors-should-do-when-black-friday-comes-2015-11-25

If the market rallies tomorrow, it doesn't mean anything.

I will book the profit and add short positions.

That is my trader's mindset.

A good article by Mark Hulbert:

http://www.marketwatch.com/story/what-stock-investors-should-do-when-black-friday-comes-2015-11-25

Wednesday, November 25, 2015

A nice addition.

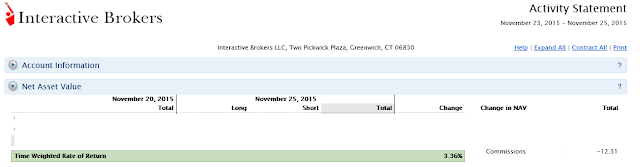

The market is always slow in the holiday seasons. I normally don't trade much during the holidays. I hold whatever I have so that I can bring some money home when the market is slow and flat. I might reduce some positions on Friday.

Monday, November 23, 2015

That is how I started this week.

As I expected, the market will not move that much. As a result, I will not trade that much. Work is slow as well. I will lay back and enjoy the slow day!

I checked out my old posts before, someone gave me a good advice back in 08. I didn't know what she was talking about until these several years when I started to do the delta neutral. The method seems simple, it really takes a lot of practices until I feel comfortable with it.

I checked out my old posts before, someone gave me a good advice back in 08. I didn't know what she was talking about until these several years when I started to do the delta neutral. The method seems simple, it really takes a lot of practices until I feel comfortable with it.

Saturday, November 21, 2015

How to survive in the market.

1. We have to stay focus. I've seen people all over the map when it comes to the trading. I used to trade like that. Now I only trade ES, NQ and YM futures and the options on them. I have no desire to try anything else for now.

2. Be vigilant and sharp. We don't want to be stubborn about our positions. When the market tells us the positions are wrong, (How? our account balance yells out at us) . We need to admit the wrong tradings and correct the mistakes. It needs practice when we actually are able to do it. One example, I held the short positions around 1940 (ES) at the beginning of the Oct over the weekend, the market rallied for 300pts. Here is the attachment for the trade that day. I admitted that my short was wrong, and went long. I know some folks who held the short positions the same as me but they didn't want to cut loss since it hurt. But it turns out my decision was right, I made all my loss back and more later.

3. We need to find a method that suits our personalities. People have different personalities, I can hold ES up or down for more than 20 pts without any problem. But others might be different. So we don't want to be a copy cat from others. We need to focus on ourselves. We need to review the methods and review the trade record for improvement.

4. Don't spend too much time on eye-balling the market. Most of the time the market is dull. We need to find something thing to do other than the market. I check how the market is in the morning before I go to work and the last half an hour before closing most of the time.

5. Don't day-trade. I know people probably disagree with me on this. It didn't work for me when I actively traded back in 09 and 10. I've started to make a steady return after I give up individual stocks and day trading.

6. We need to spend the money we made from the market. I'm very proud and motivated after spending the money.

7. Be confident. I know I will make money next year as well. :-)

2. Be vigilant and sharp. We don't want to be stubborn about our positions. When the market tells us the positions are wrong, (How? our account balance yells out at us) . We need to admit the wrong tradings and correct the mistakes. It needs practice when we actually are able to do it. One example, I held the short positions around 1940 (ES) at the beginning of the Oct over the weekend, the market rallied for 300pts. Here is the attachment for the trade that day. I admitted that my short was wrong, and went long. I know some folks who held the short positions the same as me but they didn't want to cut loss since it hurt. But it turns out my decision was right, I made all my loss back and more later.

3. We need to find a method that suits our personalities. People have different personalities, I can hold ES up or down for more than 20 pts without any problem. But others might be different. So we don't want to be a copy cat from others. We need to focus on ourselves. We need to review the methods and review the trade record for improvement.

4. Don't spend too much time on eye-balling the market. Most of the time the market is dull. We need to find something thing to do other than the market. I check how the market is in the morning before I go to work and the last half an hour before closing most of the time.

5. Don't day-trade. I know people probably disagree with me on this. It didn't work for me when I actively traded back in 09 and 10. I've started to make a steady return after I give up individual stocks and day trading.

6. We need to spend the money we made from the market. I'm very proud and motivated after spending the money.

7. Be confident. I know I will make money next year as well. :-)

Friday, November 20, 2015

Wednesday, November 11, 2015

Tuesday, November 10, 2015

Monday, November 9, 2015

11/10/15 Tuesday plan

Buy long at 10am-->11am or in the last hour. If it drops more than 3 digit, I will start to reduce the short position. Today I bought long around ES 1970 and kept it after all. I will set a limit sell now.

Sunday, November 8, 2015

This is how I started this week.

I can book the profit and claim that I have another winning week. But I don't stop there. When the P&L approaches 5K if I get lucky, I might do it. Otherwise, I will adjust the long and short position and make sure that I can reach the goal while being cautious. Doing so, I might lose the profit you are seeing now. But I can take this risk. :-)

Saturday, November 7, 2015

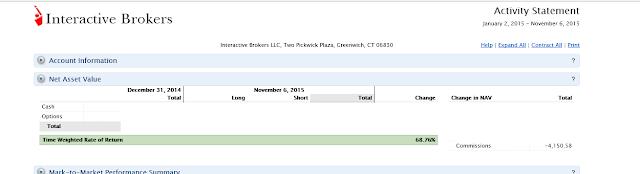

YTD performance

The percentage seems pretty high. It is based on the account balance on Jan 2,2015. I deposited more money twice this year since I didn't want to use more than 40% of the capital and withdrew a lot in the middle of September to purchase a house.

Oh. well. The $$ amount is more than my annual income for a senior software engineer in NW. It is not the end of the year yet. I still want to collect more money down the road from the market.

Last year my commission was $6500. Ha! I'm making progress. I will review my trade record for the past week pretty soon. Oops, I need to go. I will review it tomorrow.

Oh. well. The $$ amount is more than my annual income for a senior software engineer in NW. It is not the end of the year yet. I still want to collect more money down the road from the market.

Last year my commission was $6500. Ha! I'm making progress. I will review my trade record for the past week pretty soon. Oops, I need to go. I will review it tomorrow.

11.2--11.6 Trade Reviews

That is the market summary. I will add how I speculated and traded later.

Monday:

The stock market rallied to begin November with the Nasdaq Composite setting the pace. The tech-heavy index surged 1.5% while the S&P 500 (+1.2%) followed right behind. Equity indices started the trading day on an inconspicuous note after the overnight session featured some mixed economic data. In China, October Manufacturing PMI missed expectations (49.8; expected 50.0) while final Caixin PMI improved to 48.3 from 47.6, but remained below 50.0, indicating continued contraction. Asian markets ended the day on a broadly lower note, but the investor sentiment improved after European participants joined the fray and the market was treated to mostly better than expected PMI readings from regional economies. The eurozone Manufacturing PMI improved to 52.3 from 52.0 (expected 52.0), helping lift European markets off their opening lows. Once the U.S. session got going, an opening trot higher turned into a daylong charge paced by energy and biotechnology as both groups built on their October gains. Biotech names wasted no time, rallying from the opening bell to send the iShares Nasdaq Biotechnology ETF (IBB 338.06, +12.60) higher by 3.9%. For its part, the health care sector spiked 2.1%, but the group was overtaken by the energy sector (+2.4%) during the afternoon.

Starting the week, I held the long and short position I built on the previous Wednesday. I added long on the previous Friday.

The weekly goal has been reached after the market rallied for 165 pts. I kept all positions. I added more position on the long side and hedged with one short position.

Tuesday:

Stocks registered their second consecutive advance on Tuesday with the S&P 500 climbing 0.3%. The benchmark index settled a bit behind the Nasdaq Composite (+0.4%) and the Dow Jones Industrial Average (+0.5%) with cyclical sectors pacing the advance. Equity indices saw modest losses at the start of the trading day, but the market was able to overcome the early weakness thanks to continued leadership from the energy sector as the growth-sensitive group surged 2.5% to extend its weekly gain to 5.0%. The Tuesday rally was powered by a 3.8% spike in crude oil, which settled at $47.90/bbl, while top-weighted components like Chevron (CVX 98.14, +3.18) and ExxonMobil (XOM 86.83, +1.55) posted respective gains of 3.4% and 1.8%.

The account balance kept going up and I really were struggled whether I should book all profit or not. After checking the vix chart, I felt the pull back was imminent. But I really was not sure how much the pull back was. At last I only added more short position. (My new solution is to close all, but I didn't).

Wednesday:

The market snapped its two-day streak on Wednesday, but the midweek pullback was fairly modest in scope. The S&P 500 shed 0.3% while the Nasdaq Composite (-0.1%) outperformed, settling just below its flat line. Equity indices began the day on a modestly higher note, but the slight early strength faded quickly, sending the major averages into the red during the opening hour. In addition, investors heard from Fed Chair Janet Yellen who addressed the House Financial Services Committee to discuss regulation and supervision of financial institutions; however, the Q&A portion drifted towards questions about the upcoming December policy meeting with Fed Chair Yellen reiterating that a rate hike could happen in December if economic data shows improvement. Eight sectors ended the day in negative territory with energy (-1.0%) spending the bulk of the session behind the remaining nine groups. It is worth noting that the slide followed a 5.0% gain over the previous two days and the sector also had to contend with selling in the commodity market where crude oil fell 3.4%, ending the pit session at $46.32/bbl.

I started to regret about my Tuesday's action since the balance was down with the market's pulling back although the short positions were above water.

Anyway, I added one long position.

Thursday:

Equity indices posted their second consecutive decline on Thursday with the S&P 500 shedding 0.1% while the Nasdaq Composite (-0.3%) underperformed. Broadly speaking, the Thursday affair was fairly quiet, but that was not particularly surprising considering investors were set to receive the Employment Situation report for October on Friday morning. Biotechnology was largely responsible for Thursday's relative weakness in the tech-heavy Nasdaq with Valeant Pharmaceuticals (VRX 78.77, -13.21) back in focus, diving 14.4%, amid continued concerns about the company's revenue recognition practices.

My account was flat and I didn't want any additional risks so that I didn't trade.

Friday:

Dow +46.90 at 17910.33, Nasdaq +19.38 at 5147.12, S&P -0.73 at 2099.20

The S&P 500 could not avoid its third consecutive decline on Friday as rising rate hike expectations weighed on equities. To be fair, the benchmark index missed a green close by 0.74 points while the Dow (+0.3%) and Nasdaq Composite (+0.4%) erased their opening losses.

Equities stumbled at the start after the October Employment report easily surpassed expectations, thus increasing the likelihood of a fed funds rate hike at the December policy meeting to 69.8% from yesterday's 58.1%. Specifically, October nonfarm payrolls came in at 271,000 while the Briefing.com consensus expected a reading of 181,000. Also of note, hourly earnings rose 0.4% while the consensus expected an uptick of 0.2%.

NFP. I woke up early at 5:10AM and closed some long position before the announcement and added one short position. If I didn't wake up that early, I probably would not have traded. After I was awake, I felt like that I wanted to reduce the risk.

I booked some profit. Later the day I added more long position and called it a week. I still have the short positions I built last week and this week.

The account balance is at the highest for the week. I should add more short position next week.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 17663.54 | 17910.33 | 246.79 | 1.4 | 0.5 |

| Nasdaq | 5053.75 | 5147.12 | 93.37 | 1.8 | 8.7 |

| S&P 500 | 2079.36 | 2099.20 | 19.84 | 1.0 | 2.0 |

| Russell 2000 | 1161.86 | 1199.75 | 37.89 | 3.3 | -0.4 |

Tuesday, November 3, 2015

11/4/15 plan

I need to build more short positions.

I built the first short at ES 2099 on Monday and the second short at ES 2109 with existing long positions built last week. The goal for the this week has been reached. I might close all tomorrow or on Thursday.

I built the first short at ES 2099 on Monday and the second short at ES 2109 with existing long positions built last week. The goal for the this week has been reached. I might close all tomorrow or on Thursday.

Subscribe to:

Comments (Atom)

Hello, Everyone!

I've become a very mature trader after trading in the stock market for 12 years. I've been very focus and only trade E-min futures a...

-

is very simple. I've realized one key thing in trading success after being through earlier this year is to keep it to yourself. I usua...

-

I have been bullish for several weeks and I started with the neutral position and I cut loss on the short position during the week last wee...

-

I will write lesson to learn this weekend. But here is the ES range for this week for now : 1898.75---- 1987.75